Linear depreciation calculator

The declining balance method with switch to straight line method The straight line method only. D P - A.

Straight Line Depreciation Calculator Double Entry Bookkeeping

Under MACRS the deduction for depreciation is calculated by one of the following methods.

. A P 1 - R100 n. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. The Car Depreciation Calculator uses the following formulae.

The average car depreciation rate is 14. The MACRS system of depreciation allows for larger depreciation deductions in the early years and lower deductions in the later years of ownership.

Straight Line Depreciation Formula And Excel Calculator

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

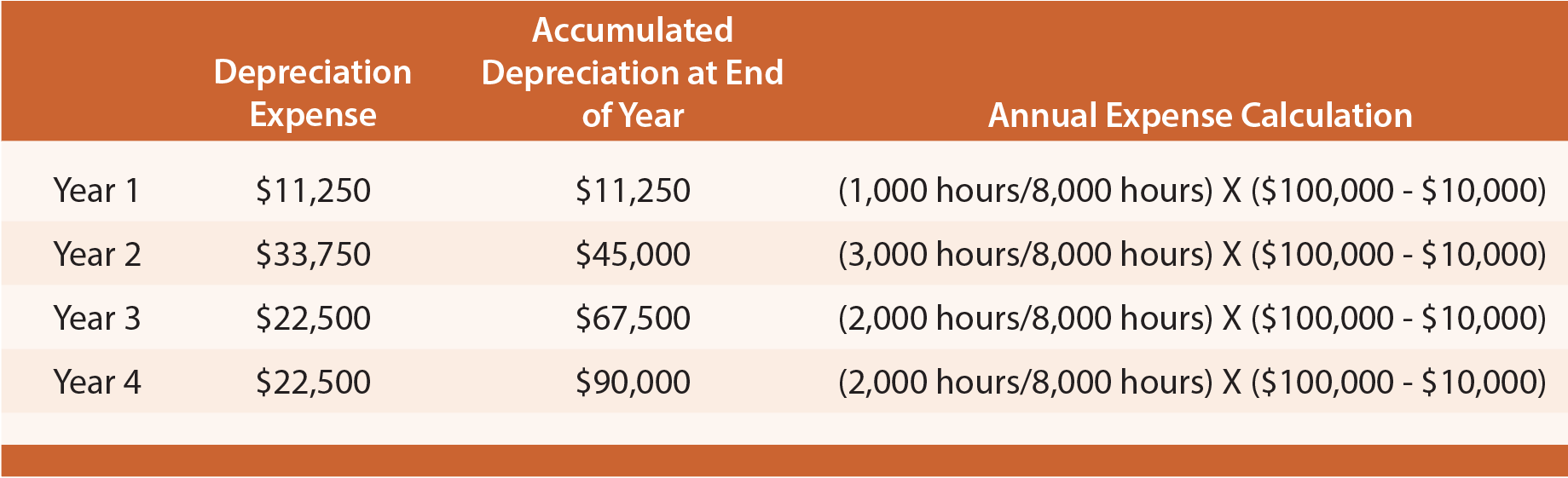

Depreciation Formula Calculate Depreciation Expense

Linear Automobile Depreciation Ppt Video Online Download

1 Free Straight Line Depreciation Calculator Embroker

Excel Straight Line Depreciation Calculator Spreadsheet Free Download

Double Declining Balance Depreciation Daily Business

Straight Line Depreciation Formula And Excel Calculator

Straight Line Depreciation Accountingcoach

Macrs Depreciation Calculator With Formula Nerd Counter

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Template Download Free Excel Template

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Double Entry Bookkeeping

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Methods Principlesofaccounting Com